Gartner TMS Magic Quadrant - what should we understand about it?

4th Issue in workstream of B) LogTech Reviews & Info - Understand how Gartner TMS MQ is being build, who is on and who is not there & why?!

Gartner is the refence authority when it comes to evaluating suites of software and putting each vendor and its solution on what is called a magic quadrant (MG). Already the adjective Magic tells us that this source is as good as reading from a crystal ball predicting future and giving insights. Well I did exaggerate now but in some ways it is true.

In this article we would focus on recently issued TMS MQ (original report here). Now I would like to share little insight how is this MQ build and what can we observe from its data, which vendors are missing and lastly few updates on Lightweight TMSs providers.

A) HOW IS MQ List being made and HOW are vendors evaluated?

Well, each vendor has to pay some sum of money to be considered for this list. Remember this is premium list you want to be in. So small or medium vendors that has limited budget may really not like to do that. But, also other large vendors may decide not to go for it (refer to later section C).

Gartner at the bottom of the page explains very well how they consider vendors to be eligible (volume of bookings, growth, breath of solution with must, may and nice elements) and certainly takes all effort to make this a fair game for everyone. Vendor needs to submit quite some collateral, fill in questionnaires - but mainly need to perform a demo to Gartner folks and provide few customer references who will confirm what vendor is trying to say.

Sizeable vendor will definitely have happy customer that they use for any reference and who will talk the right things, and smart vendor will also invest effort and preparation for the short 30 mins demo to Gartner to go totally smooth and show the solution as slick as possible.

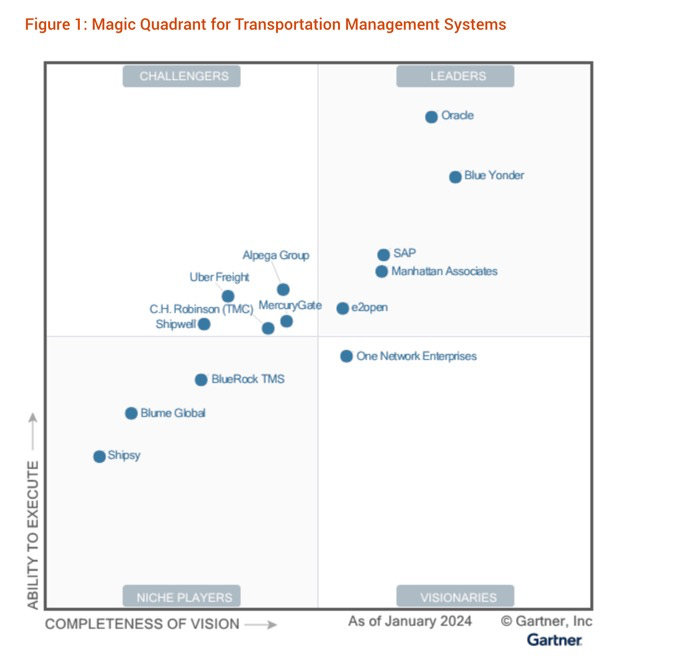

B) Current MQ for 2024 and its result

For comparison - look at below 2 screengrabs showing the development of the MQ and its players, interesting, isnt it?

Gartner MQ TMS 2023 report here

MQ as of Feb 2023:

Gartner MQ TMS 2024 report here

MQ as of March 2024:

Notable observations:

→ Oracle is way up now - as per the report Oracle's OTM is leading its way where most convincing is their ability to deliver, good job!

→ BlueYonder also becomes stronger YoY, and now with their purchase of OneNetwork (“only” player in visionaries quarter) their offering especially at “Network TMS” may become stronger. But keep in mind OneNetwork was not only the network, they also offered supply chain planning and forecasting solutions.

→ SAP TM remains about the same - good and not a good news. We see here in Europe TM is being adopted by many shippers, who mainly because of need to replace legacy SAP based transport solution, automatically (without due diligence) grab for default's SAP TM offer. Having said that SAP TM is still in its breath and capability certainly leader in this MQ, but one may say is little out of breath behind its main 2 rivals. There are some talks about SAP introducing more “lightweight” fully cloud based TM?!

→ New entry - Blume Global - its little unusual type of software vendor for 2 reasons as minimum - they are very strong servicing LSPs and mainly train operators in NA and second they have been acquired last year by WiseTech (here) so should WiseTech (CargoWise) be here now?

→ CH Robinson, Uber Freight and Mercury Gate have strong presence mainly in North America (NA) . It is important when evaluating TMS vendor to distinguish two aspects - where are all the users of your software - most of them answers “all over the world”, but where are your paying customers - for these 3 it would be mainly NA.

C) WHO IS NOT ON THE LIST ?

CargoWise (company WiseTech with HQ in Australia, www.cargowise.com) - is by today a strong TMS player in Freight Forwarding and LSP industry. I dare to say that some 60% of freight forwarding operation is using CargoWise. They on other side are not too much established in shipper community, and that is maybe why their last year's Blume purchase comes handy?! Definitely a strong player in TMS industry.

Descartes (www.descartes.com) and its TMS offering that is coupled by quite strong trade compliance tools, their footprint grows also into air shipping, real time visibility and specialty TMS for LSPs.

Infor Nexus (www.infor.com/solutions/scm/infor-nexus) also used to be known as GT Nexus - US based sizable software provider acting as separate product within its owner Infor, focusing very strongly on multi-modal visibility, ocean collaboration and "network-based” TMS with strong presence among LSPs in inbound logistics.

Transporeon (www.transporeon.com) - German based still start-up few years ago, now sizable platform with multi-modal reach. They do not refer to themselves as TMS, but carry many features of the "Network TMS” including allocation management, transport execution, superb real-time visibility offering, rate management and rate benchmarking, and many midsize shippers use it as its primary transport solution.

These 4 would definitely be in position to successfully compete on this MQ and maybe a good alternatives in leaders or at least challengers quarter. For some reason they decide not to. What does this tells us?

a) that the MQ is really not complete, some of these vendors present themselves at "competing” analysts

b) these vendors obviously do not believe in this and are not willing invest the effort

c) Gartner MQ is a good but not the only source for your TMS evaluation!

D) Ligthweight TMS

Lastly I would love to give short introduction to some interesting niche players / newcomers and start-ups that are making waves, and may maybe soon end up on one of these analysts quadrants.

In some context these players are considered as "Lightweight TMS” providers.

Count with me:

BuyCo - www.buyCo.co - originally a spin off from CMA-CGM, Marseille based has presented very dynamic grow among large ocean shippers. Their value is on providing “all-in” ocean operating system for importers and exporters who decide to do insourcing of their international transport processes.

Cargoo - www.cargoo.com - Swiss based, ocean shipping focused platform for inbound logistics, most of their customers are coffee or commodity importers, their focus is on large shippers (kind of competing with BuyCo) and they provide not only "Network TMS” but also relevant visibility, all API enabled.

Cargo Base (www.cargobase.com) - quite for a while established player out of Singapore with focus on cargo spot process and air transport. Their customers are in automotive, spare parts, semiconductors or electronics, and their deployment is based on complementing large "standard” TM with giving agility in spot or air process management.

FreightOS (www.freightOs.com) - took me a while to decode about their value, essentially it is a rate / tariff sharing platform with the ability to also make carrier / LSP reservation. Perhaps not a core TM, but very important for execution and benchmarking. FreightOs has also sister platform WebCargo with focus on air rates and air reservations. This team is mainly based in Barcelona and is issuing regular benchmarking price reports and industry insights.

Elogate (www.elogate.com) - very nimble and agile Austria based start-up, with focus on manufacturers and exporters with solutions for planning, loading, on premise management as well as on carrier connectivity. Currently focus is middle Europe, but with this grow we see them soon elsewhere.

More about the niche players aka "lightweight TMSs” in my next blog post.

Thank you!

Jakub